Listen up, folks. If you're scratching your head about what the PPP warrant list is and how it impacts businesses and individuals, you're not alone. This whole PPP (Paycheck Protection Program) thing has been a hot topic since the pandemic hit, and understanding it can feel like trying to solve a Rubik's cube blindfolded. But don’t sweat it—we’re here to break it down for you in a way that makes sense. Whether you're a small business owner or just curious about how this all works, this guide is your go-to resource.

Now, let's get into it. The PPP warrant list is basically a collection of data related to businesses that received loans under the Paycheck Protection Program. This program was designed to help businesses keep their employees on payroll during tough times. But here's the kicker—there's been a lot of scrutiny around who got these loans and why. That’s where the warrant list comes in. It’s like a public ledger that sheds light on the whole process.

So, why should you care? Well, if you're a business owner, knowing how the PPP warrant list works can help you navigate financial challenges. And if you're an individual, understanding this stuff can give you insight into how government programs are being used to support the economy. Stick around because we’re diving deep into the nitty-gritty of it all. No jargon, just real talk.

Read also:Hdhub4u Movie A Cinematic Hub For Enthusiasts

Table of Contents:

- What is the PPP Warrant List?

- Why is the PPP Warrant List Important?

- How to Access the PPP Warrant List?

- Who is Eligible for PPP Loans?

- Benefits of PPP Loans

- Challenges Faced by Businesses

- Data Analysis of the PPP Warrant List

- Legal Considerations for PPP Loans

- Future Outlook for PPP and Similar Programs

- Conclusion and Next Steps

What is the PPP Warrant List?

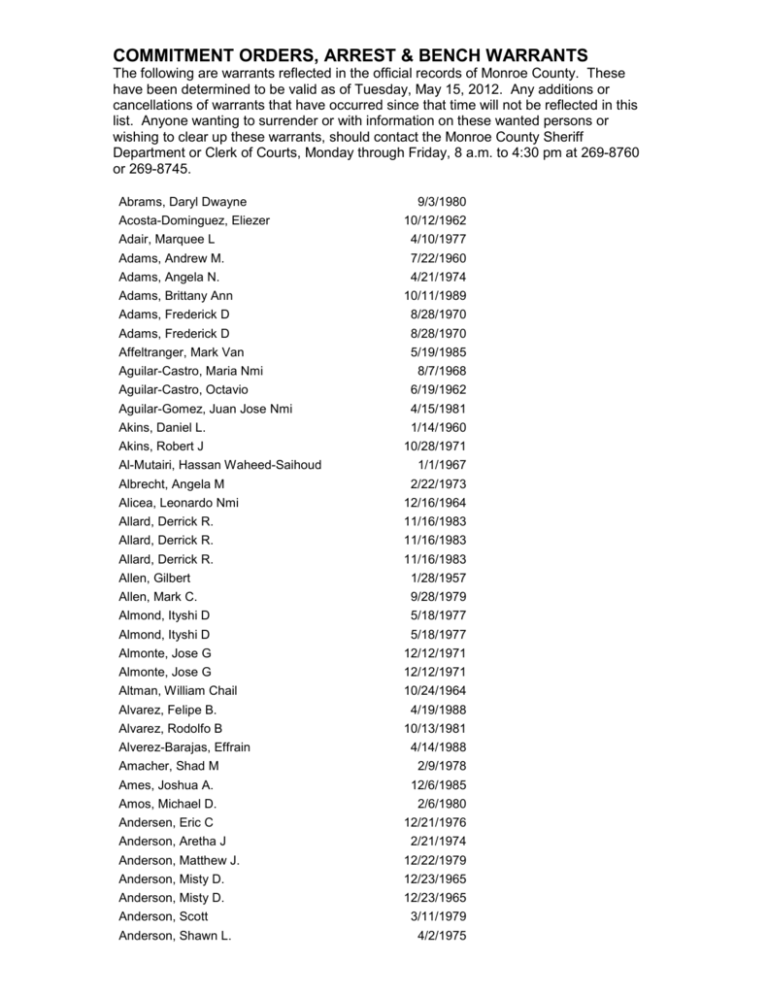

Alright, let’s start with the basics. The PPP warrant list is essentially a database that tracks businesses and individuals who have received loans through the Paycheck Protection Program. Think of it as a digital record that keeps tabs on who got what and how much. The program was rolled out as part of the CARES Act back in 2020, and its main goal was to help businesses stay afloat during the pandemic.

Here’s the deal: when businesses apply for PPP loans, they agree to certain terms and conditions. Some of these loans come with warrants, which are kind of like equity stakes in the business. These warrants give the government a slice of the pie if the business does well down the road. It’s a way to balance out the financial risk for taxpayers while still providing much-needed support to struggling businesses.

Key Features of the PPP Warrant List

Now, let’s break down some of the key features of the PPP warrant list:

- It’s publicly accessible, meaning anyone can check it out.

- It includes details like the business name, loan amount, and whether warrants were issued.

- It’s updated regularly to reflect new data and changes in the program.

And here’s the kicker—it’s not just about the big corporations. Small businesses and even sole proprietors can be part of this list. So, whether you’re running a mom-and-pop shop or a tech startup, there’s a chance your business could be on there.

Why is the PPP Warrant List Important?

Let’s talk about why this list matters. First off, it’s a transparency thing. The public has a right to know how taxpayer money is being spent, and the PPP warrant list gives us a clear picture of that. It’s not just about numbers; it’s about accountability. Businesses that receive PPP loans are under scrutiny, and the list helps ensure that the program is being used as intended.

Read also:Embrace The Essence Of Musalmani Sexy A Cultural Perspective Thatrsquoll Make You Rethink Beauty

But here’s the thing—it’s not all sunshine and rainbows. There have been cases of misuse and fraud, and the list can help shine a light on those situations. It’s like a watchdog for the economy, keeping everyone honest and on their toes.

Impact on Businesses and Individuals

For businesses, being on the PPP warrant list can have both positive and negative effects. On the plus side, it shows that you’re taking steps to keep your employees on payroll and maintain operations. On the flip side, it can also attract unwanted attention if there are any red flags in your application.

As for individuals, understanding the list can help you make informed decisions about your financial future. Whether you’re considering starting a business or just curious about how the program works, having access to this data can be a game-changer.

How to Access the PPP Warrant List?

Okay, so you want to check out the PPP warrant list for yourself. How do you do that? Well, it’s actually pretty straightforward. The Small Business Administration (SBA) maintains the list, and you can access it through their official website. Just head over to the SBA’s PPP data portal, and you’ll find all the info you need.

Here’s a quick step-by-step guide:

- Go to the SBA’s website and navigate to the PPP data section.

- Choose whether you want to search by business name, location, or loan amount.

- Enter your search criteria and hit submit.

- Voilà! You’ll get a list of businesses that match your search.

It’s that simple. And don’t worry if you’re not a tech wizard—you don’t need any special skills to use the portal. Just basic computer knowledge will do.

Who is Eligible for PPP Loans?

Now, let’s talk about eligibility. Not every business can qualify for a PPP loan, so it’s important to know the rules. Generally speaking, small businesses with fewer than 500 employees are eligible. But there are some exceptions, so it’s worth checking the fine print.

Here are some of the key eligibility criteria:

- Your business must have been operational before February 15, 2020.

- You must have paid employees or independent contractors.

- You must demonstrate a need for the loan due to the economic uncertainty caused by the pandemic.

And here’s a pro tip—make sure you keep detailed records of your payroll and expenses. If you ever need to prove your eligibility, having solid documentation will make your life a lot easier.

Common Misconceptions About Eligibility

There are a few common misconceptions about who can and can’t get a PPP loan. For example, some people think that only businesses in certain industries qualify. Not true! As long as you meet the basic criteria, you’re good to go.

Another myth is that you need to have a perfect credit score to apply. Again, not true. While credit history might be a factor, it’s not the only thing that matters. So don’t let those myths hold you back from exploring your options.

Benefits of PPP Loans

Alright, let’s talk about the good stuff—the benefits of PPP loans. First and foremost, they’re designed to help businesses keep their employees on payroll. That’s huge, especially during tough economic times. But there are other perks too.

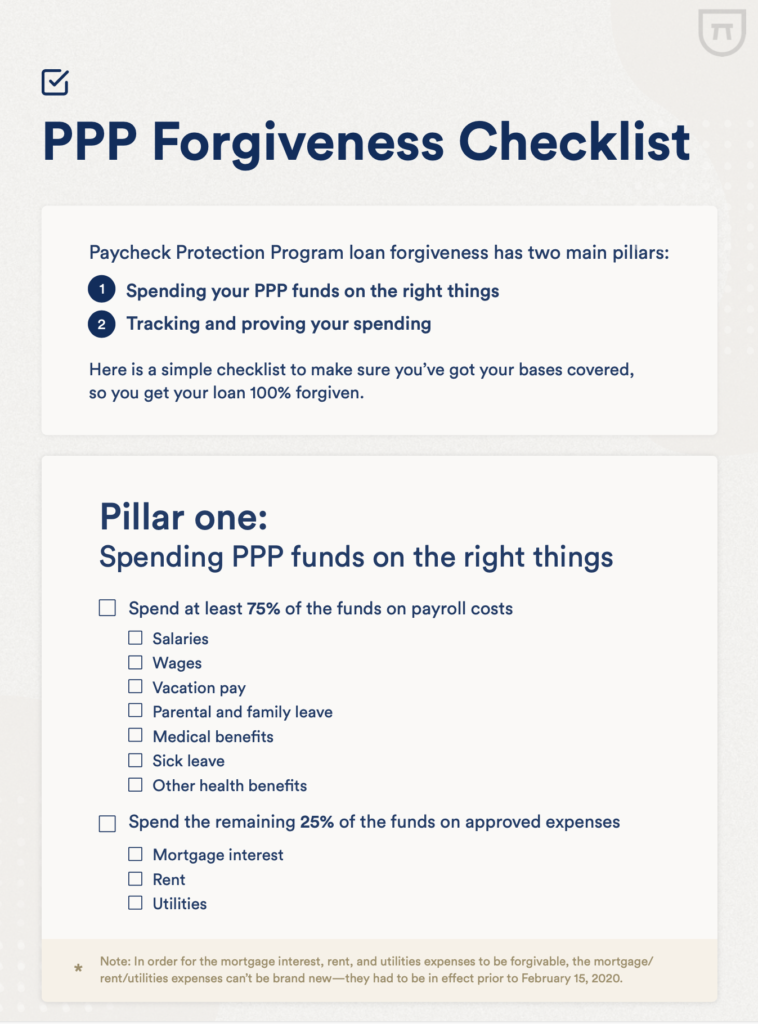

For starters, PPP loans come with a pretty sweet interest rate—around 1% or less. And if you use the funds for eligible expenses like payroll, rent, and utilities, you might even qualify for loan forgiveness. That means you don’t have to pay it back. Sounds pretty good, right?

How to Maximize Your Benefits

Here are a few tips to help you get the most out of your PPP loan:

- Use the funds for eligible expenses only. This increases your chances of getting the loan forgiven.

- Keep detailed records of how you spend the money. This will come in handy when you apply for forgiveness.

- Stay in touch with your lender. They can provide guidance and support throughout the process.

And remember, the goal is to keep your business running smoothly. So, use the funds wisely and focus on your long-term success.

Challenges Faced by Businesses

Of course, no program is perfect, and the PPP has its share of challenges. One of the biggest issues is the complexity of the application process. It can be overwhelming, especially for small business owners who are juggling a million other things.

Another challenge is the uncertainty around loan forgiveness. Even if you meet all the requirements, there’s no guarantee that your loan will be forgiven. And let’s not forget about the fraud and misuse that we mentioned earlier. It’s a constant battle to ensure that the program is being used as intended.

Overcoming These Challenges

So, how can businesses overcome these challenges? Here are a few strategies:

- Seek professional guidance. Working with a financial advisor or accountant can help you navigate the process.

- Stay informed. Keep up with the latest updates and changes to the program.

- Be proactive. Don’t wait until the last minute to apply or submit your paperwork.

It’s all about being prepared and staying on top of things. The more you know, the better equipped you’ll be to handle any challenges that come your way.

Data Analysis of the PPP Warrant List

Now, let’s dive into the data. The PPP warrant list is a treasure trove of information, and analyzing it can give you valuable insights into how the program is being used. For example, you can look at trends in loan amounts, industry distribution, and geographic coverage.

Here are some interesting stats:

- As of 2022, over 11 million PPP loans have been approved, totaling more than $800 billion.

- The majority of loans went to small businesses with fewer than 20 employees.

- The hospitality and retail sectors were among the biggest recipients of PPP funds.

And here’s the kicker—data analysis can help you identify patterns and make informed decisions. Whether you’re a business owner or a researcher, this info can be incredibly valuable.

Legal Considerations for PPP Loans

Now, let’s talk about the legal side of things. PPP loans come with certain legal obligations, and it’s important to understand them. For starters, you need to comply with all the terms and conditions of the loan agreement. This includes using the funds for eligible expenses and keeping accurate records.

Failure to comply can result in penalties, including fines and even criminal charges in extreme cases. So, it’s crucial to take this stuff seriously. And if you’re ever in doubt, don’t hesitate to consult with a legal professional.

Best Practices for Legal Compliance

Here are a few best practices to help you stay on the right side of the law:

- Read and understand the loan agreement before signing.

- Keep detailed records of all transactions related to the loan.

- Seek legal advice if you’re unsure about any aspect of the program.

Remember, compliance is key. The last thing you want is to run into legal trouble because you didn’t dot your i’s and cross your t’s.

Future Outlook for PPP and Similar Programs

Looking ahead, it’s hard to say exactly what the future holds for PPP and similar programs. The pandemic has created a lot of uncertainty, and the economic landscape is constantly evolving. However, one thing is clear—government support for small businesses will likely continue in some form or another.

Here are a few trends to watch:

- Increased focus on digital transformation and innovation.

- More emphasis on sustainability and environmental responsibility.

- Greater use of data analytics to improve program effectiveness.

So, whether you’re a business owner or just interested in the topic, keep an eye on these developments. They could have a big impact on how businesses operate in the future.

Conclusion and Next Steps

Well, there you have it—an essential guide to the PPP warrant list for businesses and individuals. We’ve covered everything from the basics to the nitty